2024 End of Year Report

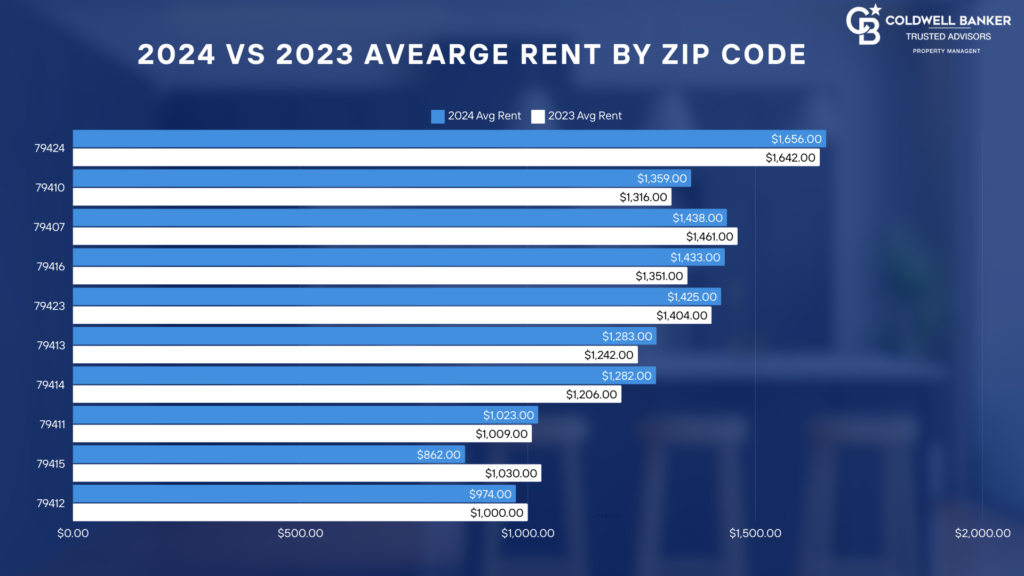

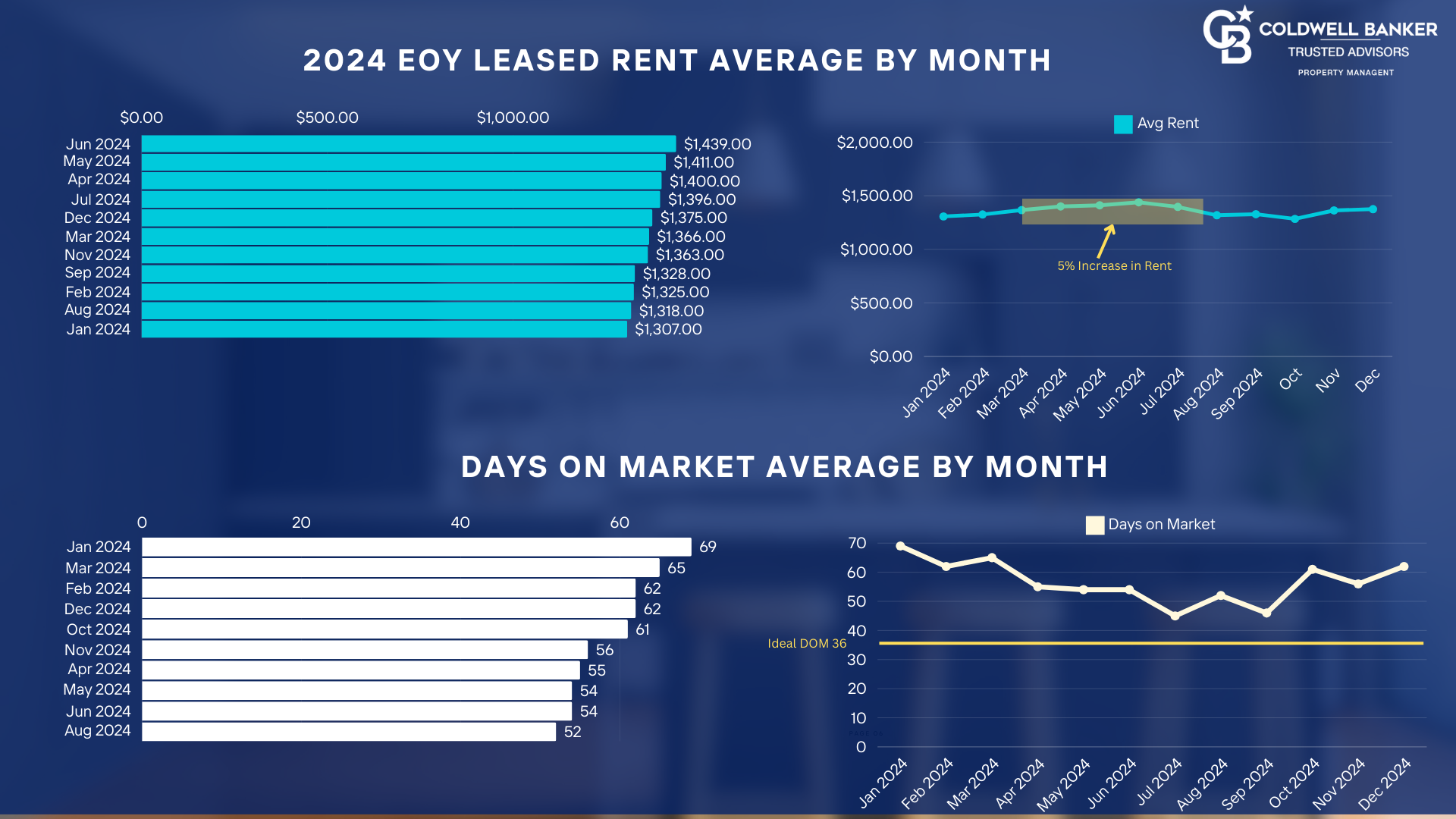

In 2024, Lubbock’s single-family rental market experienced modest growth. The average rent increased by approximately 1.74% in the first quarter compared to the same period in 2023, marking the most significant growth in a year, though still below the national inflation rate. This uptick suggested potential momentum as the market approached the robust second quarter. However, the third and fourth quarters saw a slowdown, solidifying a trend where rents were approximately 5% higher during the late first and second quarters than the rest of the year. By December 2024, the market had 1,740 homes for sale, a 4.3% increase from the previous month, indicating a growing inventory. Despite these developments, Lubbock remained a buyer’s market, with the supply of homes exceeding demand.

The Lubbock real estate market has entered uncharted waters, where renting a home has become cheaper than owning one. When renting becomes more affordable than homeownership, several market shifts typically occur. First, homeownership demand tends to decrease as more potential buyers opt to rent, leading to longer listing times and possible price reductions in the sales market. Second, rental demand often increases, increasing rental prices if inventory remains limited. Third, investors may shift their strategies, with some landlords capitalizing on the strong rental market while others exit the market due to reduced property appreciation potential. Lastly, homebuilders may adjust their focus, slowing down single-family home construction in favor of multifamily developments to meet the growing rental demand. These trends indicate a potential rebalancing of Lubbock’s real estate market in the coming years.

Let’s discuss if these trends are hitting Lubbock.

-Oscar Armendariz

Decrease in Home Ownership?

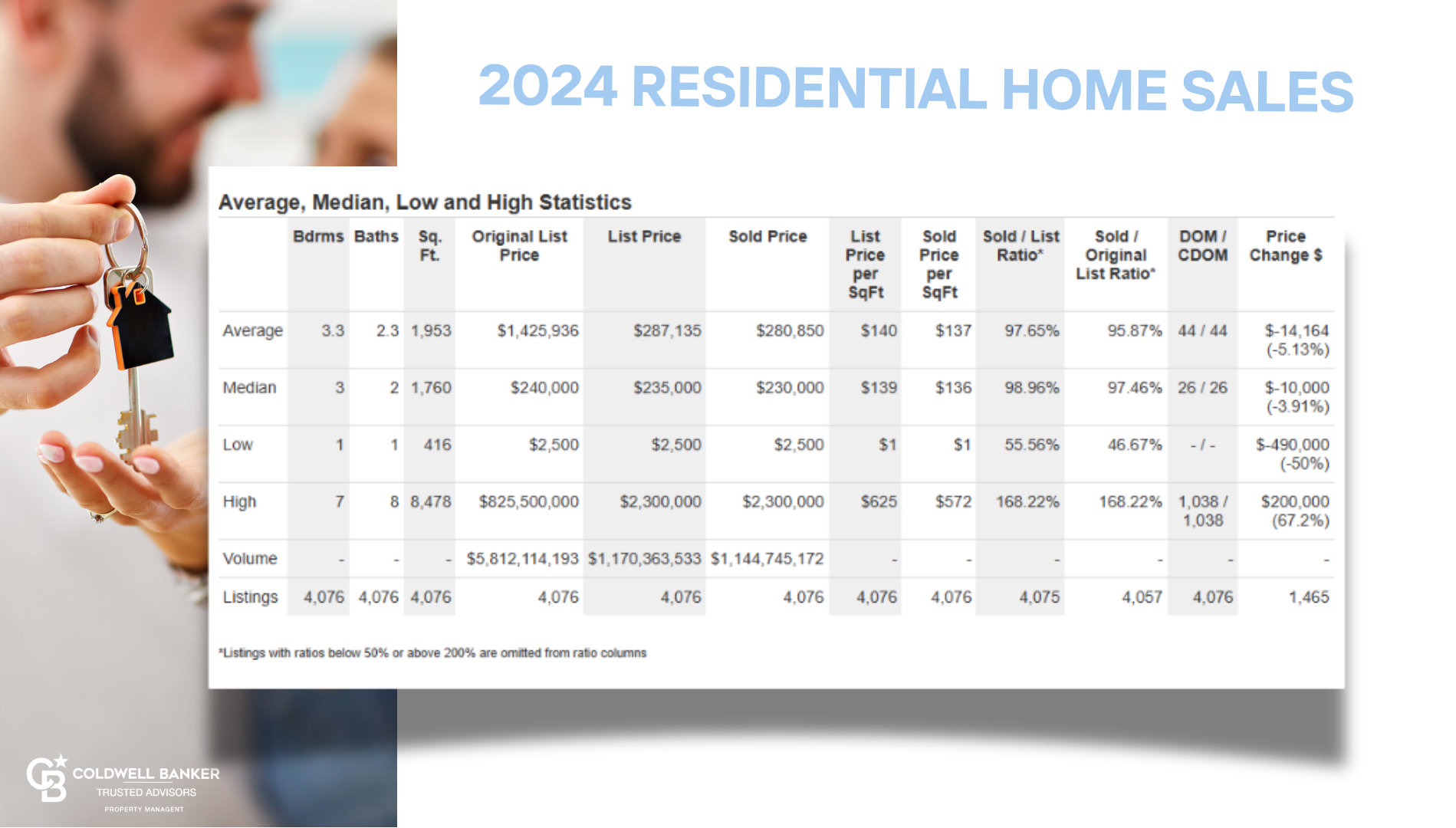

We are not seeing this data right now. Despite the increased population and job growth, our market has swung into a buyer’s market. It’s important to note that home prices and sales are not falling. In 2024 and 2023, roughly had 4000 homes sold. These numbers reflect a typical market more than the outlier years of 2021 and 2021

Rental Demand Increase?

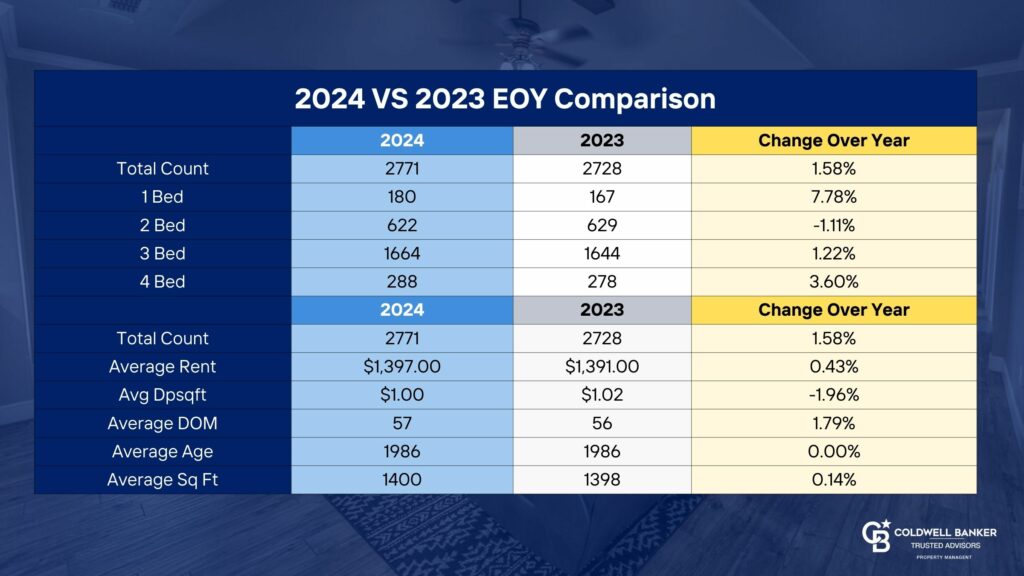

I can confidently say that rental demand is not increasing. This can be tracked by monitoring days on the market and the absorption rate.

The average number of days on the market was 38 in 2021 and 42 in 2022. The median was 25 and 29, respectively. In 2024, the average DOM was 54.

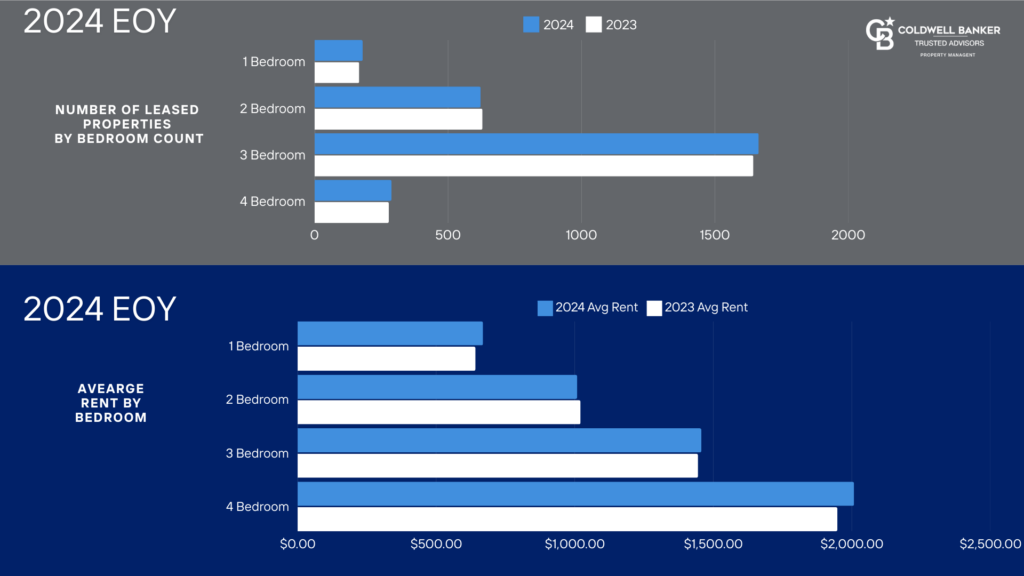

While the number of rented properties has increased, so has the available rentals. The supply is greater than the demand.

In 2019, the average rent in Lubbock was $1078. In 2022, the average rent rose 20% to $1351. As of 2024, the average rent is $1358. Effectively the same. Even if demand has increased, supply has met the call and then some. In 2021, the market absorbed 85% of what was listed. Compared to 77% in 2024

Investors Exiting the Market?

This number is more challenging to track. I can only speak anecdotally on this, but Lubbock is seeing this. We have seen more owners selling homes in their portfolio compared to previous years. This started in 2021 when home prices began to rise so quickly. Many investors sold homes to cash in but also lost low interest rates that they had on said property. Many investors had cash-bought investments as home prices were peaking and when rents peaked at the same time. The sales market and rental started to cool simultaneously, and more rental inventory was hitting the market toward the end of 2022. By 2024 inflation costs of repairs and insurance have caused many investors to now exit the rental investment, despite having loans with really great rates.

Homebuilders Adjusting Focus?

Home builders are not adjusting their focus. With high interest rates and a softening market, they are simply slowing down. Builders are offering concessions that one could only dream about two years ago. The multifamily world is developing slowly, but making that deal work with bank interest rates in the 9% range is tough.

Builders like Betenbough are still developing SE Lubbock, NW Lubbock, and Wolforth. We are seeing that investors gravitate to new construction investments. Betenbough is offering really deep incentives to entice investors. While new construction may be more expensive than buying an older property, you can minimize maintenance costs. Most renters love shiny and new.

Talk to us about our leasing fee waiver on new construction homes.

2025 Predictions

- It will be easier to navigate these familiar waters. Don’t expect much to change.

- We can expect rental rates to increase and days on the market to fall in the middle of the year. Then, rents will fall, and days on the market will increase around mid-August.

- Inventory levels will likely mirror 2024.

For Lubbock. - Demand for rentals is not expected without some other exterior factor, like higher interest rates, lending guidelines becoming more strict, or sudden population growth. All of these seem unlikely.

Parting Thoughts

The Lubbock Real Estate market can only be defined as weird. Much like you would describe your middle school-aged child. Think of high interest rates as braces. They eventually come off, but while they are on, they are a pain. The growing pains of investing cash right now but not really seeing that return that you typically expected. An untimely vacancy at the wrong time of the year that acts like a pimple that won’t clear by picture day. Lubbock is sitting on a stage where you can see so much potential. You know it’s coming; we must get through this awkward phase.

For a detailed view of the 2024 End of Year report, click on the rental report. You can get a printable copy by clicking here.

Work with Coldwell Banker

Simplified Property Ownership

Managing investment properties involves a myriad of tasks, from tenant screenings and rent collection to maintenance and legal compliance. Our comprehensive property management services are designed to take these burdens off your shoulders. We handle everything, ensuring your properties are well-maintained and profitable, allowing you to focus on what matters most to you.

Expertise in All Property Types

Whether you own a single-family home or a multifamily apartment complex, our team has the expertise to manage a diverse range of properties. We understand the unique needs and challenges of different property types and tailor our services to meet those needs efficiently and effectively.

Clear and Concise Communication

One of the cornerstones of our service is our commitment to clear and concise communication. We believe that transparency is key to a successful partnership. You will always be kept in the loop regarding the status of your properties, tenant issues, financial reports, and any other pertinent information. Our goal is to ensure you have complete confidence and peace of mind, knowing that your investments are in capable hands.

Cutting-Edge Technology

In today’s fast-paced world, staying ahead of technological advancements is crucial. At Coldwell Banker Residential Property Management, we leverage the latest technology and systems to enhance our services. From online portals for easy access to property information and financial reports to advanced marketing tools that attract high-quality tenants, we use technology to streamline processes and maximize efficiency.

Service-Oriented Approach

Despite our reliance on technology, we never forget that we are, first and foremost, a service company. Our priority is to provide exceptional service to both property owners and tenants. We pride ourselves on being responsive, attentive, and dedicated to meeting your needs. Our team is always ready to go the extra mile to ensure your satisfaction and the smooth operation of your properties.

Partnering with Coldwell Banker Residential Property Management means entrusting your investment properties to a team of experienced professionals who are committed to simplifying property ownership. With our expertise, clear communication, cutting-edge technology, and unwavering dedication to service, we ensure that your properties are managed efficiently and effectively. Let us help you maximize the potential of your investment properties while providing you with the peace of mind you deserve.

Contact us today to learn more about how we can assist you in achieving your property management goals.