We have just passed Q2 and are officially past the halfway point of 2023. As temperatures increase, we see increases in Q2 for the rental market. Some good and some bad. Overall, rent prices are increasing, but so are the vacancy days. A market analysis always looks back so we can try to predict what’s ahead. I state the obvious because it is important to remember that Q2 is typically your strongest quarter, and the third and fourth quarters are weaker, typically weaker quarters in real state. So as we review, it is important to read between the lines and prepare for the last half of the year. The takeaway is to REDUCE your vacancy days by any means necessary. Reducing vacancy is achieved in 2 ways, price and/or condition. If your property is not leasing, it is either price or condition. You should look to eliminate condition elements first.

Condition is the hardest variable only because the average landlord complicates the process. Once you realize that you can not make every tenant prospect love your home, you realize that condition means that you get your property to a state where 80% of the market will like the home. This is typically achieved by paint, flooring, and clean bathrooms.

The price is simple. No tenant has ever complained about a lower rent, but the name of the game is profit. Often owners get fixated on high rents and need to remember that single-family rentals are a marathon, not a sprint. Low vacancy rates, turnover, and maintenance costs can achieve profitability. These things are achieved by having homes in good condition, to begin with.

Overall Q2 Look

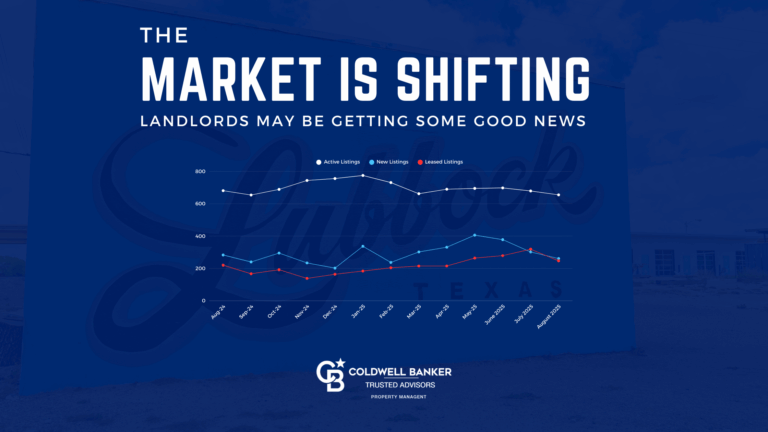

Below will show overall market averages for 2023 Q2 compared to 2023 Q1 and 2022 Q2. If you think it feels different than last year, you’re right. While rents have increased an average of 5%, the vacancy days on the market have increased by 42%. So you may be getting more in rent. It just takes you a longer period to get it. The numbers also show that rents are up from the 1st quarter and the days on the market are down. This makes sense, given that Q2 is historically the stronger quarter.

2023 Q2 | |||||

2023 Q2 | 2023 Q1 | 2022 Q2 | Change Over Quarter | Change Over Year | |

Total Count | 786 | 717 | 724 | 9.62% | 8.56% |

Average Rent | $1,426.00 | $1,318.00 | $1,355.00 | 8.19% | 5.24% |

Avg Dpsqft | $1.00 | $1.00 | $0.99 | 0.00% | 1.01% |

Average DOM | 57 | 61 | 40 | -6.56% | 42.50% |

Average Age | 1987 | 1983 | 1982 | 0.20% | 0.25% |

Average Sq Ft | 1444 | 1373 | 1393 | 5.17% | 3.66% |

A Deeper Look

New Rentals Listed | |||||

2023 Q2 | 2023 Q1 | 2022 Q2 | Change Over Quarter | Change Over Year | |

Total Count | 910 | 1171 | 909 | -22.29% | 0.11% |

1 Bed | 44 | 96 | 53 | -54.17% | -16.98% |

2 Bed | 202 | 277 | 203 | -27.08% | -0.49% |

3 Bed | 547 | 646 | 570 | -15.33% | -4.04% |

4 Bed | 115 | 145 | 81 | -20.69% | 41.98% |

Two and three Bedroom units make up the vast majority of the market. However, we are seeing an increase in 4-bedroom activity from 2022. We will continue to see that trend but will likely stay within three and 2-bedroom availability. Four-bedroom homes did increase in rent and decrease in vacancy from Q1.

Leased Properties | |||||

2023 Q2 | 2023 Q1 | 2022 Q2 | Change Over Quarter | Change Over Year | |

Total Count | 786 | 717 | 48 | 9.62% | 1537.50% |

1 Bed | 38 | 52 | 179 | -26.92% | -78.77% |

2 Bed | 192 | 155 | 426 | 23.87% | -54.93% |

3 Bed | 467 | 432 | 68 | 8.10% | 586.76% |

4 Bed | 84 | 77 | 3 | 9.09% | 2700.00% |

Activity by Zip Code

Compared to last year, all neighborhood days on market dates are up. Some more significant than others, 79424, 79416, and 79423, have felt that biggest impact. Days on the market for 79416 increased 81%, and rents have only increased an average of 3.45% from 2022.

Zip Code | 2023 Q2 Count | 2023 Q2 Avg Rent | 2023 Q2 DOM | 2023 Q1 Count | 2023 Q1 Avg Rent | 2023 Q1 DOM | 2022 Q2 Count | 2022 Q2 Avg Rent | 2022 Q2 DOM | Rent- Change over Quarter | DOM- Change Over Quarter | Rent – Change Over Year | DOM Change Over Year |

79424 | 118 | $1,710.00 | 50 | 99 | $1,611.00 | 55 | 126 | $1,612.00 | 33 | 6.15% | -9.09% | 6.08% | 51.52% |

79410 | 74 | $1,357.00 | 67 | 66 | $1,448.00 | 57 | 73 | $1,337.00 | 57 | -6.28% | 17.54% | 1.50% | 17.54% |

79407 | 64 | $1,606.00 | 46 | 51 | $1,426.00 | 61 | 49 | $1,508.00 | 40 | 12.62% | -24.59% | 6.50% | 15.00% |

79416 | 108 | $1,408.00 | 69 | 94 | $1,350.00 | 85 | 115 | $1,361.00 | 38 | 4.30% | -18.82% | 3.45% | 81.58% |

79423 | 137 | $1,461.00 | 47 | 124 | $1,333.00 | 50 | 113 | $1,403.00 | 27 | 9.60% | -6.00% | 4.13% | 74.07% |

79413 | 83 | $1,326.00 | 61 | 69 | $1,255.00 | 46 | 61 | $1,320.00 | 43 | 5.66% | 32.61% | 0.45% | 41.86% |

79414 | 39 | $1,250.00 | 50 | 60 | $1,154.00 | 61 | 38 | $1,228.00 | 31 | 8.32% | -18.03% | 1.79% | 61.29% |

79411 | 43 | $1,085.00 | 71 | 42 | $1,000.00 | 51 | 54 | $970.00 | 48 | 8.50% | 39.22% | 11.86% | 47.92% |

79415 | 9 | $925.00 | 49 | 14 | $960.00 | 49 | 3 | $900.00 | 57 | -3.65% | 0.00% | 2.78% | -14.04% |

79412 | 13 | $1,117.00 | 53 | 20 | $941.00 | 57 | 20 | $1,123.00 | 36 | 18.70% | -7.02% | -0.53% | 47.22% |

Activity by Bedroom

Bedrooms | 2023 Q2 Count | 2023 Q2 Avg Rent | 2023 Q2 DOM | 2023 Q1 Count | 2023 Q1 Avg Rent | 2023 Q1 DOM | 2022 Q2 Count | 2022 Q2 Avg Rent | 2022 Q2 DOM | Rent- Change over Quarter | DOM- Change Over Quarter | Rent – Change Over Year | DOM Change Over Year |

1 | 38 | $668.00 | 56 | 52 | $617 | 41 | 48 | $614.00 | 50 | 8.27% | 36.59% | 8.79% | 12.00% |

2 | 192 | $1,065.00 | 50 | 155 | $982 | 43 | 179 | $1,042.00 | 35 | 8.45% | 16.28% | 2.21% | 42.86% |

3 | 467 | $1,518.00 | 59 | 432 | $1,668 | 62 | 426 | $1,467.00 | 39 | -8.99% | -4.84% | 3.48% | 51.28% |

4 | 84 | $2,044.00 | 57 | 77 | $1,955 | 62 | 68 | $1,985.00 | 45 | 4.55% | -8.06% | 2.97% | 26.67% |

Activity By Rent Range

The days on the market have increased significantly in the price points where most rentals are leasing out. This results from a saturation point in the market at these price points. With several build-to-rent neighborhoods developing around Lubbock, the popularity of single-family homes for investments. We can see this trend continue throughout 2023.

Rent Range | 2023 Q2 Count | 2023 Q2 Avg Rent | 2023 Q2 DOM | 2023 Q1 Count | 2023 Q1 Avg Rent | 2023 Q1 DOM | 2022 Q2 Count | 2022 Q2 Avg Rent | 2022 Q2 DOM | Rent- Change over Quarter | DOM- Change Over Quarter | Rent – Change Over Year | DOM Change Over Year |

<750 | 53 | $658.00 | 54 | 86 | $623 | 54 | 48 | $614.00 | 50 | 5.62% | 0.00% | 7.17% | 8.00% |

750-900 | 55 | $839.00 | 44 | 54 | $858 | 49 | 54 | $834.00 | 36 | -2.21% | -10.20% | 0.60% | 22.22% |

901-1000 | 46 | $978.00 | 49 | 38 | $971 | 42 | 39 | $969.00 | 48 | 0.72% | 16.67% | 0.93% | 2.08% |

1001-1200 | 98 | $1,127.00 | 56 | 98 | $1,127 | 53 | 97 | $1,138.00 | 35 | 0.00% | 5.66% | -0.97% | 60.00% |

1201-1300 | 70 | $1,275.00 | 58 | 99 | $1,277 | 75 | 71 | $1,277.00 | 37 | -0.16% | -22.67% | -0.16% | 56.76% |

1301-1400 | 85 | $1,368.00 | 56 | 77 | $1,372 | 72 | 74 | $1,380.00 | 33 | -0.29% | -22.22% | -0.87% | 69.70% |

1401-1500 | 110 | $1,480.00 | 63 | 83 | $1,479 | 62 | 112 | $1,481.00 | 36 | 0.07% | 1.61% | -0.07% | 75.00% |

1501-1600 | 65 | $1,576.00 | 65 | 45 | $1,570 | 81 | 64 | $1,582.00 | 44 | 0.38% | -19.75% | -0.38% | 47.73% |

1601-1800 | 101 | $1,722.00 | 61 | 57 | $1,722 | 57 | 80 | $1,725.00 | 44 | 0.00% | 7.02% | -0.17% | 38.64% |

1801-2000 | 50 | $1,921.00 | 60 | 36 | $1,917 | 59 | 38 | $1,945.00 | 39 | 0.21% | 1.69% | -1.23% | 53.85% |

2001-2200 | 21 | $2,133.00 | 47 | 13 | $2,152 | 35 | 10 | $2,135.00 | 51 | -0.88% | 34.29% | -0.09% | -7.84% |

2201-2500 | 13 | $2,357.00 | 62 | 14 | $2,364 | 84 | 13 | $2,354.00 | 52 | -0.30% | -26.19% | 0.13% | 19.23% |

2501-2750 | 17 | $2,641.00 | 48 | 12 | $2,629 | 59 | 5 | $2,625.00 | 25 | 0.46% | -18.64% | 0.61% | 92.00% |

$2750+ | 10 | $3,158.00 | 46 | 5 | $2,800 | 17 | 5 | $2,905.00 | 29 | 12.79% | 170.59% | 8.71% | 58.62% |