Strength

- Lower cost of entry

Because property purchase prices are relatively low compared to major Texas metros (DFW, Austin, Houston), the amount of capital required is lower. That helps mitigate downside risk. - Historic home appreciation

Some metrics (Redfin, REALTORS) show mid-single-digit YoY appreciation. If you choose well (in a good location, with good condition, and a desirable neighborhood), you will capture capital gains over time. - Stable economy

The local economy is driven by agriculture, medicine, and education. All industries that have historically served Lubbock well. - Reasonable rental demand

With occupancy in the high 80s, there is demand, possibly from students, the local workforce, etc. For smaller, affordable homes, there may be decent tenant demand. - Lower competition, possibly more negotiating room

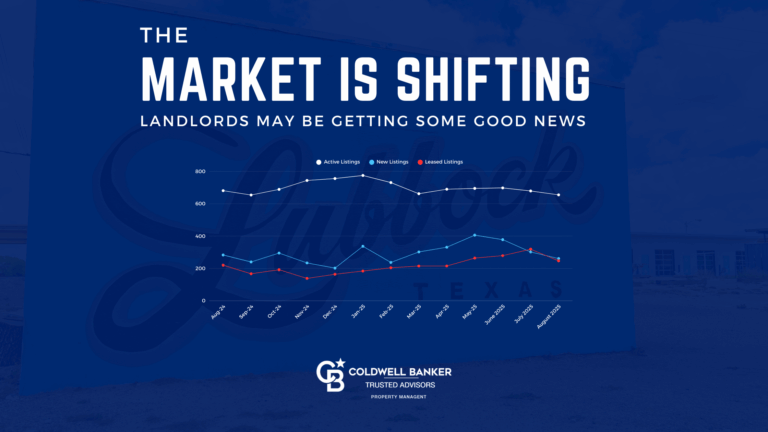

With increasing inventory, longer days on market, there may be more ability to find bargains or get favorable purchase terms.

Weakness

- Slow rent growth

Flat or slightly decreasing rents vs purchase price increases is a red flag if you’re counting too much on cash flow. With only modest rent increases, your revenue growth is limited. - Rising costs & financing risks

Mortgage rates are still high relative to pre-pandemic lows. Maintenance, property taxes, insurance, vacancy, and turnover costs can eat into returns. - Longer hold likely needed

Capturing appreciation may require holding the property for several years, perhaps 5-10, to ride cycles. If you need liquidity sooner, risk increases. - Selectivity matters

The gap between good deals and bad deals are likely wider than in overheated markets. Neighborhood, condition, and financing terms matter a lot more.

Verdict

Given what I see, here’s what I personally would think if I were considering Lubbock:

I would cautiously say yes, for the right deals. Lubbock doesn’t look terrible; in fact, many of the risk factors are more manageable (lower entry cost, less overheated than big metros), which gives room for a margin of safety.

But I would not go into it expecting high short-term cash flow or rapid appreciation. The realistic expectation is modest cash flow (maybe break-even or slightly positive after expenses), with appreciation doing a fair share of the total return over time.

I would insist on:

- Strong yield deals: buy at a discount, minimal repairs, low ongoing maintenance, stable tenant base.

- Conservative underwriting: assume rent growth low (0-2% annually), budget for vacancies, rising expenses, etc.

- Solid location: avoid distressed or declining neighborhoods; pick areas near jobs, amenities, schools.

- Sufficient reserves: for unexpected costs, possible short vacancy, and repair.

Also, I would compare opportunity cost: what returns could you get elsewhere (other markets, other asset classes) with similar risk and capital. If you have access to a more favorable location or asset type, that might be higher return per risk.