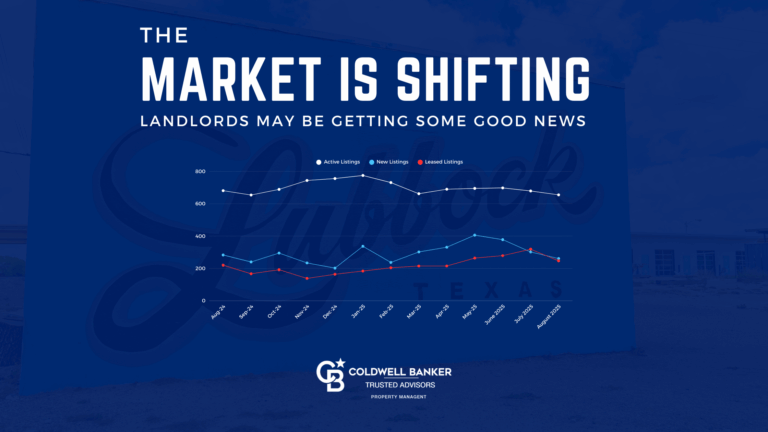

Lubbock, Texas Year to Date Numbers

July Market Overview

July started hot with leasing but cooled off faster than anticipated. The new rental inventory slightly increased compared to June but remained low relative to other months. This is a good thing; we need an inventory reduction.

The number of leased homes decreased from June, continuing a downward trend. Ideally we would like to see an increase for July. This decrease in activity seems to mirror the sales market, where the sales market saw a decrease in undercontract properties.

The average rent also dropped from $1,439 to $1,396, which is still higher than January’s average of $1,318.

Outlook for the Rest of the Year

The rest of 2024 seems likely to mirror 2023 closely. Desirable properties are expected to lease quickly, as usual. In contrast, properties perceived as less updated may experience longer days on the market. The critical takeaway remains to focus on controllable factors. Property owners should prioritize updates where possible, adopt aggressive pricing strategies, and minimize vacancy days to maximize profitability.

Recent market reports show that the US economy maybe entering into a recession with a lack of growth. Other reports show that many American are starting to come to the end of cash reserves causing a slow down in spending. some of this is evident when restaurants are making national news with cheaper menu options.

RENT CONTROL?

The News Cycle: Rent Control

You may have seen headlines recently on rent control measures in the news. These stories typically talk about rent control measures on the East and West Coast, but recently, there have been talks about a national rent control measure. Yes, there have been talks from the White House on rent control legislation. The Biden-Harris Housing Plan aims to address housing affordability issues through the legislation proposal. Key proposals include:

- Legislation requiring corporate landlords to either cap rent increases on existing units at 5% or forfeit valuable federal tax breaks.

- Repurposing public land to build up to 15,000 additional affordable housing units in Nevada.

- Rehabilitating distressed housing and revitalizing neighborhoods, particularly in areas like Las Vegas.

While these proposals focus on increasing supply, the rent regulation that is making headlines can lead to unintended negative consequences. The plan explicitly targets corporate owners, defined as those owning 50 or more rental units. However, the likelihood of such legislation passing is slim, given the probable lack of congressional support. Nonetheless, vigilance is essential, as rent control policies can be enacted at the city level.

History and Concept

Rent control is not a new concept; it has existed since World War II. The initial purpose was to provide relief to families whose family members were fighting in the war, offering fairness in a time of crisis. While most cities discontinued rent control after the war, New York City maintained it, becoming a long-standing example of its complexities and limitations.

Why Rent Control Fails

Despite its noble intentions, rent control often produces the opposite effect. This is evident when you see that the most expensive housing markets in the country tend to have some form of rent control. Since 1946, economists have studied its impacts, agreeing that it is not fair or effective. Rent control can freeze a city’s housing development and hinder tenants’ upward mobility. It typically benefits only a small group of people.

The primary issue with rent control is that it functions as price control. Markets operate best when supply and demand reach a natural equilibrium, with price as the mediator. For rent control to work, rents would need regulation, as would the costs of repairs, insurance, and taxes. However, this is not feasible. Landlords face fixed income limits but must still deal with inflation and unregulated market prices for goods and services.

Studies show landlords often shift from long-term rental investments to developing condos and high-end properties in cities with rent control, reducing the affordable housing supply.

Addressing Housing Affordability

Solving the housing affordability crisis requires a multifaceted approach. Increasing supply is crucial, but reducing demand is not practical. Cities should encourage development, particularly in areas with growing populations. This doesn’t just mean new neighborhoods on the outskirts but also revitalizing urban areas. Developing multifamily and mixed-use buildings can increase density and tax bases without expanding the city’s footprint. Redevelopment can be cost-effective, leveraging existing infrastructure.

The “Not In My Backyard” (NIMBY) mindset poses a significant challenge to housing affordability. While respecting existing property owners’ concerns is important, city planning and zoning decisions should be based on solid data rather than anecdotal evidence. When they are not, we often end up with laws that, while well-intentioned, create paradoxical outcomes, complicating rather than solving issues. This phenomenon, amplified by social media algorithms, can lead to public misconceptions and misguided policies.

Work with Coldwell Banker

Simplified Property Ownership

Managing investment properties involves a myriad of tasks, from tenant screenings and rent collection to maintenance and legal compliance. Our comprehensive property management services are designed to take these burdens off your shoulders. We handle everything, ensuring your properties are well-maintained and profitable, allowing you to focus on what matters most to you.

Expertise in All Property Types

Whether you own a single-family home or a multifamily apartment complex, our team has the expertise to manage a diverse range of properties. We understand the unique needs and challenges of different property types and tailor our services to meet those needs efficiently and effectively.

Clear and Concise Communication

One of the cornerstones of our service is our commitment to clear and concise communication. We believe that transparency is key to a successful partnership. You will always be kept in the loop regarding the status of your properties, tenant issues, financial reports, and any other pertinent information. Our goal is to ensure you have complete confidence and peace of mind, knowing that your investments are in capable hands.

Cutting-Edge Technology

In today’s fast-paced world, staying ahead of technological advancements is crucial. At Coldwell Banker Residential Property Management, we leverage the latest technology and systems to enhance our services. From online portals for easy access to property information and financial reports to advanced marketing tools that attract high-quality tenants, we use technology to streamline processes and maximize efficiency.

Service-Oriented Approach

Despite our reliance on technology, we never forget that we are, first and foremost, a service company. Our priority is to provide exceptional service to both property owners and tenants. We pride ourselves on being responsive, attentive, and dedicated to meeting your needs. Our team is always ready to go the extra mile to ensure your satisfaction and the smooth operation of your properties.

Partnering with Coldwell Banker Residential Property Management means entrusting your investment properties to a team of experienced professionals who are committed to simplifying property ownership. With our expertise, clear communication, cutting-edge technology, and unwavering dedication to service, we ensure that your properties are managed efficiently and effectively. Let us help you maximize the potential of your investment properties while providing you with the peace of mind you deserve.

Contact us today to learn more about how we can assist you in achieving your property management goals.