Market Performance Overview

The Lubbock single-family rental market is cautiously navigating through a period of adjustment. With a modest increase of 1.74% in average rents compared to Q1 2023, the market is experiencing its most significant growth in a year, albeit below the national inflation rate. This increase is a silver lining, indicating a potential build-up of momentum as we approach the typically robust Q2. Despite these positive signs, the market faces challenges, particularly with extended days on the market and a contraction in new inventory.

Key Insights:

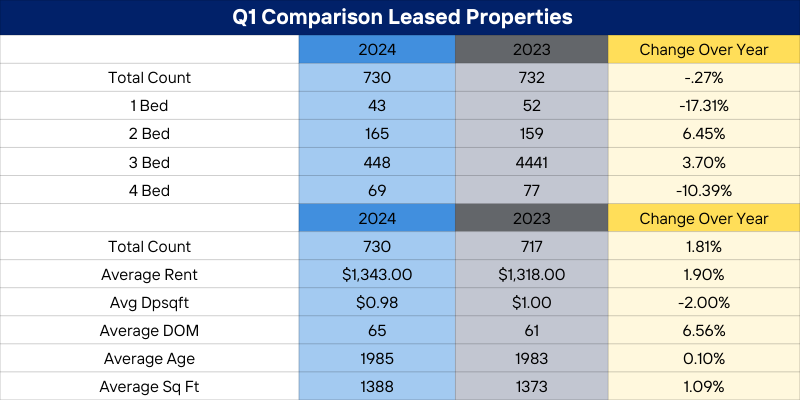

- Rental Growth: The market has recorded a 1.74% growth in average rent, marking the highest increase in the past 12 months. This growth, although modest, signals a gradual strengthening of the market as we move into the second quarter.

- Days on the Market: A persistent challenge, the average days on the market have risen to 65, a 6% increase from Q1 2023. This underscores the need for investors to refine their strategies to enhance property desirability and reduce vacancy times.

- Inventory Dynamics: The supply of new rental properties has decreased by 14% year-over-year, but roughly the same amount of leased properties year over year. This indicates a tightening market that could eventually support rent stabilization and growth.

Strategic Recommendations for Investors

To navigate the current market dynamics, investors should adopt a proactive and strategic approach:

- Pricing Strategies: Prioritize leasing speed over rental increases to enhance profitability in the face of extended market durations. Competitive pricing can be a decisive factor in this competitive landscape.

- Vacancy Reduction: Implement measures to minimize vacancy periods, including offering renewal incentives and aggressive marketing. Quick leasing is a key competitive advantage in the current market scenario.

- Investment Opportunities: With the appreciation rate of homes stabilizing around 3%, selectivity becomes crucial. Middle-tier homes emerge as attractive targets, presenting a blend of moderate updates and investment potential. Due to the market’s evolving dynamics, these properties offer a value proposition that could be more appealing.

Market Outlook

The Lubbock single-family rental market is treading a path of cautious optimism. With the anticipated seasonal strength of Q2, there is potential for momentum build-up. However, the market’s recovery and growth trajectory will be contingent on addressing the challenges of prolonged listing periods and adapting to the shifting inventory landscape.

Investors are encouraged to remain vigilant and focus on opportunities that align with nuanced market trends. As the market gradually moves towards a more balanced state, investors’ strategic positioning and adaptability will be pivotal in capitalizing on emerging opportunities.

The Lubbock single-family rental market is at a crossroads, with signs of potential upliftment tempered by ongoing challenges. As we proceed through 2024, the market’s resilience and the strategic acumen of investors will be key determinants of its trajectory. Embracing a cautious yet optimistic outlook, stakeholders can navigate the complexities of the market, positioning themselves to thrive in the evolving Lubbock landscape.