Q3 Market Notes

This quarter, I’ve taken a close look at the rental and sales markets in Lubbock to explore the relationship between the two. Traditionally, these markets are interconnected, but local conditions sometimes lead them to diverge. Lubbock is currently facing an unusual period in its real estate cycle, where typical patterns seem disrupted. In most cases, a slowdown in the sales market leads to increased rental demand. Low interest rates generally fuel home sales while slowing the rental market, but with rising interest rates this year, we haven’t seen the expected surge in rental demand.

Typical Market Cycles and Their Influence

- Sales Boom, Rental Decline: Historically, when home prices rise, more people buy, reducing rental demand.

- Sales Decline, Rental Surge: Conversely, in downturns, fewer can afford to buy, pushing up rental demand and rents.

- Interest Rates: Low interest rates reduce the cost of borrowing, encouraging home purchases and slowing rental demand. High rates should push people toward renting, yet this effect isn’t as pronounced as expected in Lubbock.

- Housing Supply: A shortage of homes tends to drive up both rental and sale prices, while a surplus eases pressure on both markets.

- Economic Factors: Recessions typically boost rental demand as fewer people can afford homeownership, while economic booms drive both buying and renting, with varying effects depending on income levels.

- Demographics: Millennials’ preference for renting and Baby Boomers renting in retirement both keep rental demand strong, potentially impacting home sales.

- Investors: Investors purchasing homes for rental income can stabilize home prices while increasing rental supply.

-Oscar Armendariz

Overall Market Comps

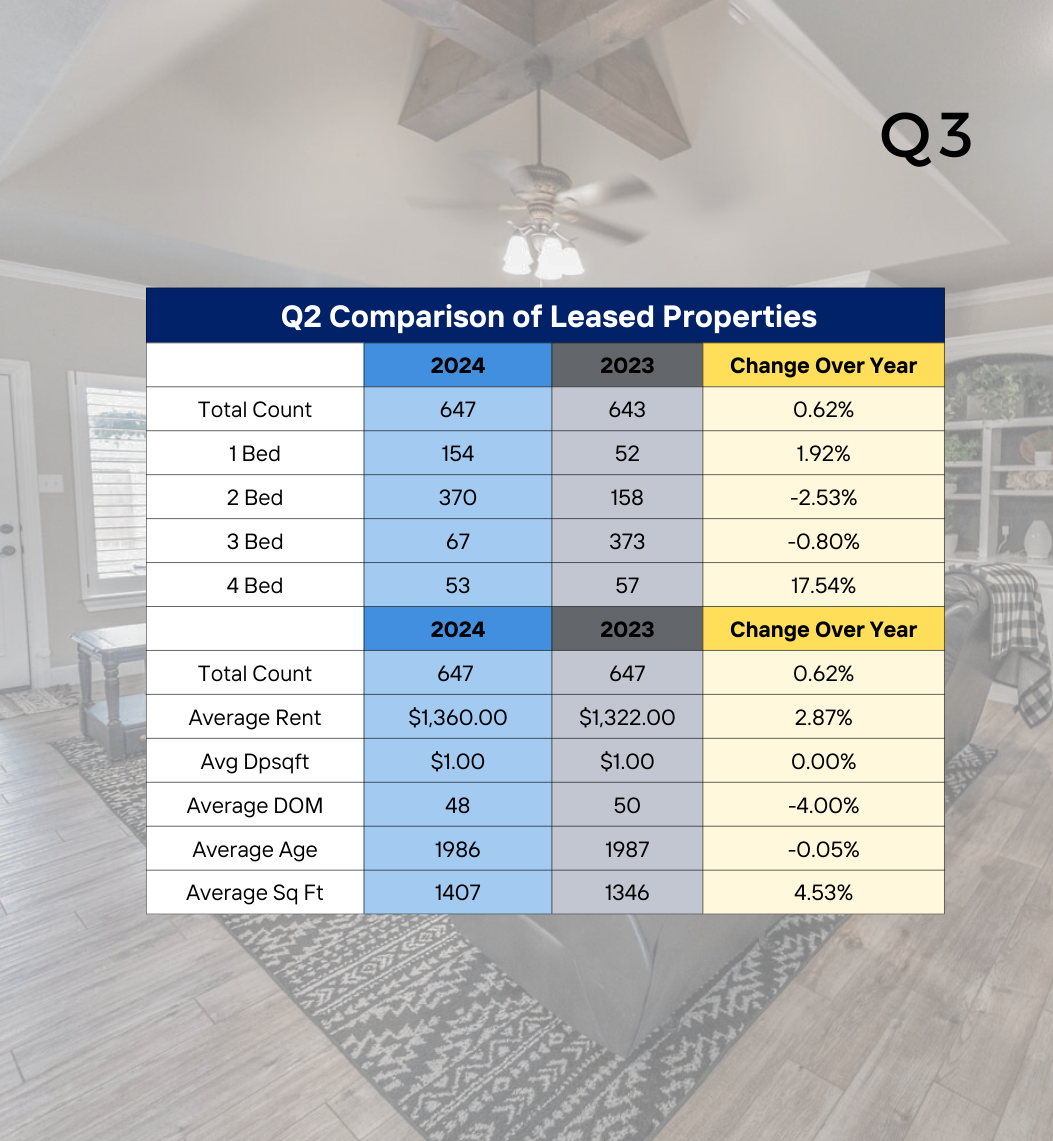

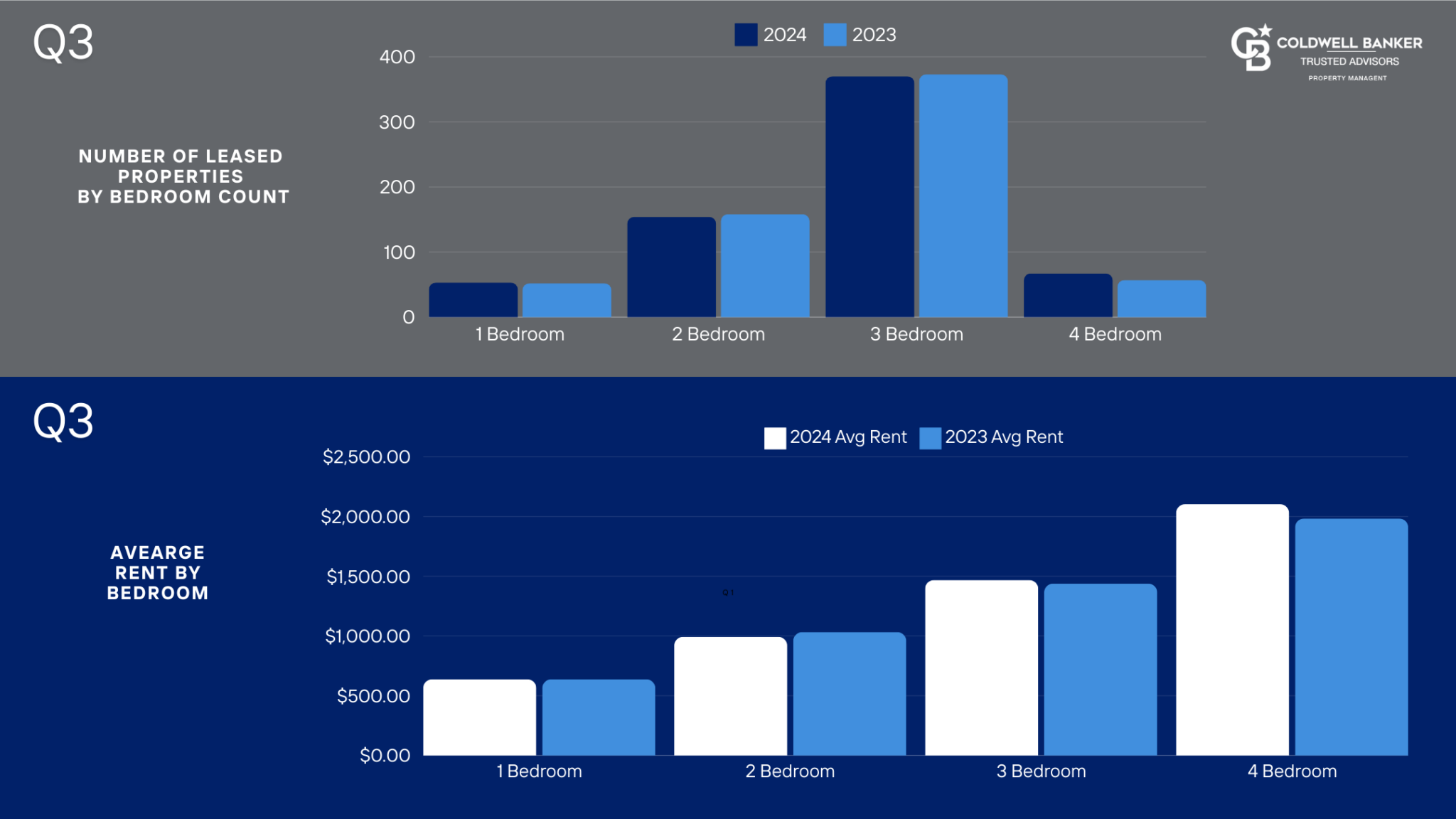

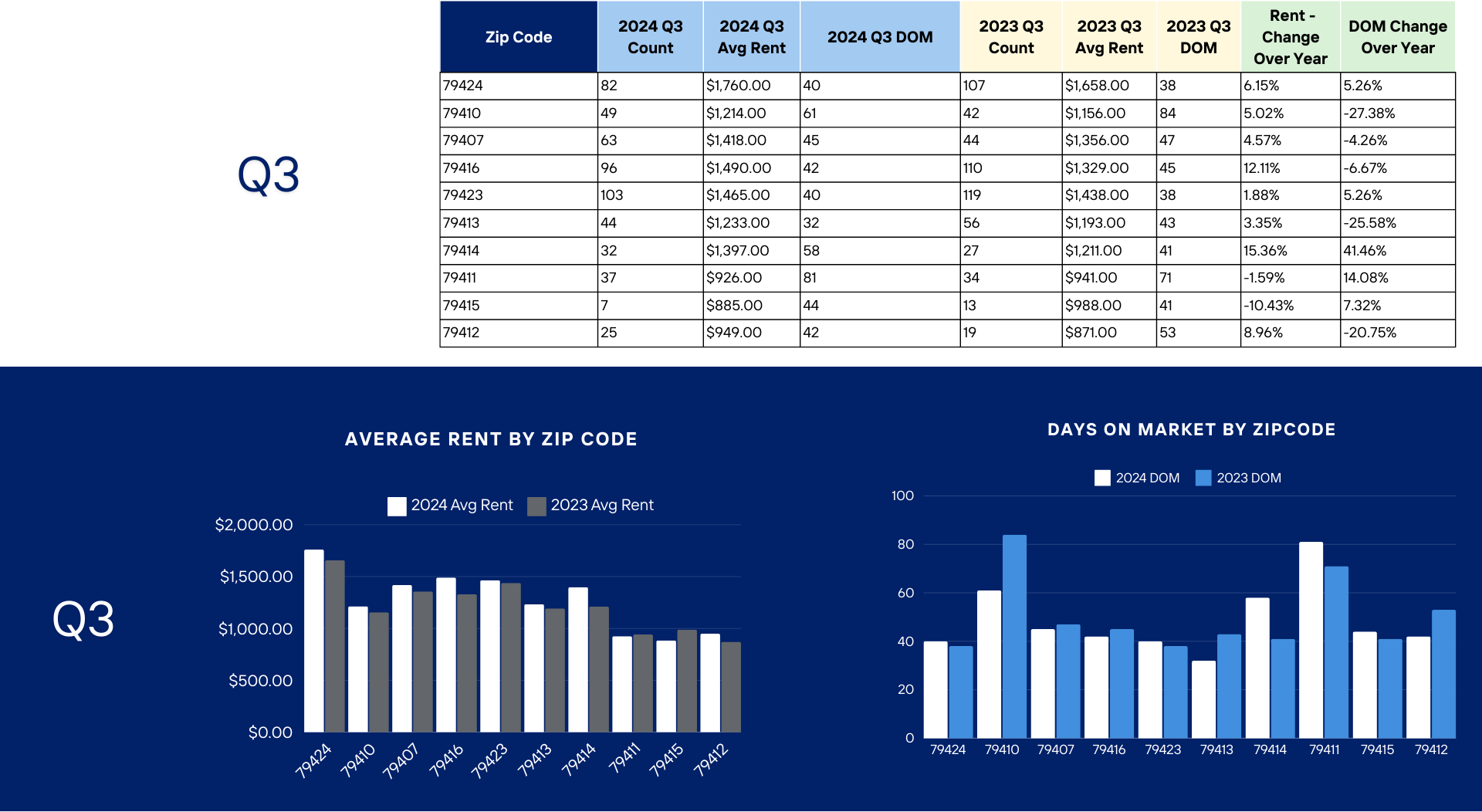

Leased Properties

The number of leased properties is virtually the same as last quarter.

Average Rents

Average rents have remained relatively flat, slightly increasing by 2.87%. This rent increase may be a bit of a false flag; with days on the market still being above 45, the reality is the bottom dollar impact would suggest more of a flat rate.

Days on Market

The average days on the market (DOM) for single-family homes reduced by 4%. This decrease indicates that properties are being rented out more quickly, which is a positive sign for landlords and property managers. However, the average of 48 days is still 18 more than what you want to see.

Parting Thoughts

Another trend is that sellers accustomed to homes selling quickly at or above asking price are now facing a more balanced market. With sales slowing, many are exploring rental options for properties that aren’t selling fast enough, contributing to a surplus of available rentals.

Interest Rates and Affordability

Even though interest rates have risen, there’s still a steady pool of buyers in Lubbock. Despite the fact that renting is now more affordable than buying when comparing monthly payments, many buyers continue to prioritize homeownership. This reflects a deep-seated cultural value on owning a home, which is keeping the sales market more active than expected.

What’s Ahead for Lubbock’s Real Estate Market?

The sales market is likely to continue shifting toward a buyer’s market. It’s important to note that this doesn’t necessarily mean falling home prices. Instead, Lubbock may experience slower appreciation rates, but prices should remain positive.

The rental market is expected to remain soft through 2025 unless there’s a significant change in supply or demand. Inventory levels for 2024 are consistent with those of 2023, and there are no clear indicators that suggest a significant shift is on the horizon.

On the demand side, population growth would need to accelerate, or stricter lending criteria would have to push potential buyers into the rental market. While high interest rates could help with this, it’s unlikely that we’ll see the kind of loan tightening required to force buyers into rentals in significant numbers.

In summary, expect a continued soft rental market throughout 2025 unless there’s a major shift in either supply or demand dynamics.

For a detailed view of the Q3 report, click on the rental report below. You can get a printable copy by clicking here.

Work with Coldwell Banker

Simplified Property Ownership

Managing investment properties involves a myriad of tasks, from tenant screenings and rent collection to maintenance and legal compliance. Our comprehensive property management services are designed to take these burdens off your shoulders. We handle everything, ensuring your properties are well-maintained and profitable, allowing you to focus on what matters most to you.

Expertise in All Property Types

Whether you own a single-family home or a multifamily apartment complex, our team has the expertise to manage a diverse range of properties. We understand the unique needs and challenges of different property types and tailor our services to meet those needs efficiently and effectively.

Clear and Concise Communication

One of the cornerstones of our service is our commitment to clear and concise communication. We believe that transparency is key to a successful partnership. You will always be kept in the loop regarding the status of your properties, tenant issues, financial reports, and any other pertinent information. Our goal is to ensure you have complete confidence and peace of mind, knowing that your investments are in capable hands.

Cutting-Edge Technology

In today’s fast-paced world, staying ahead of technological advancements is crucial. At Coldwell Banker Residential Property Management, we leverage the latest technology and systems to enhance our services. From online portals for easy access to property information and financial reports to advanced marketing tools that attract high-quality tenants, we use technology to streamline processes and maximize efficiency.

Service-Oriented Approach

Despite our reliance on technology, we never forget that we are, first and foremost, a service company. Our priority is to provide exceptional service to both property owners and tenants. We pride ourselves on being responsive, attentive, and dedicated to meeting your needs. Our team is always ready to go the extra mile to ensure your satisfaction and the smooth operation of your properties.

Partnering with Coldwell Banker Residential Property Management means entrusting your investment properties to a team of experienced professionals who are committed to simplifying property ownership. With our expertise, clear communication, cutting-edge technology, and unwavering dedication to service, we ensure that your properties are managed efficiently and effectively. Let us help you maximize the potential of your investment properties while providing you with the peace of mind you deserve.

Contact us today to learn more about how we can assist you in achieving your property management goals.