2025 1st Quarter Report

As we move further into 2025, I wanted to take a moment to share some insights on where the Lubbock rental market stands—and what it means for both new and seasoned investors. While the numbers may feel mixed, the bigger picture remains steady for those who understand the long-term nature of real estate investing.

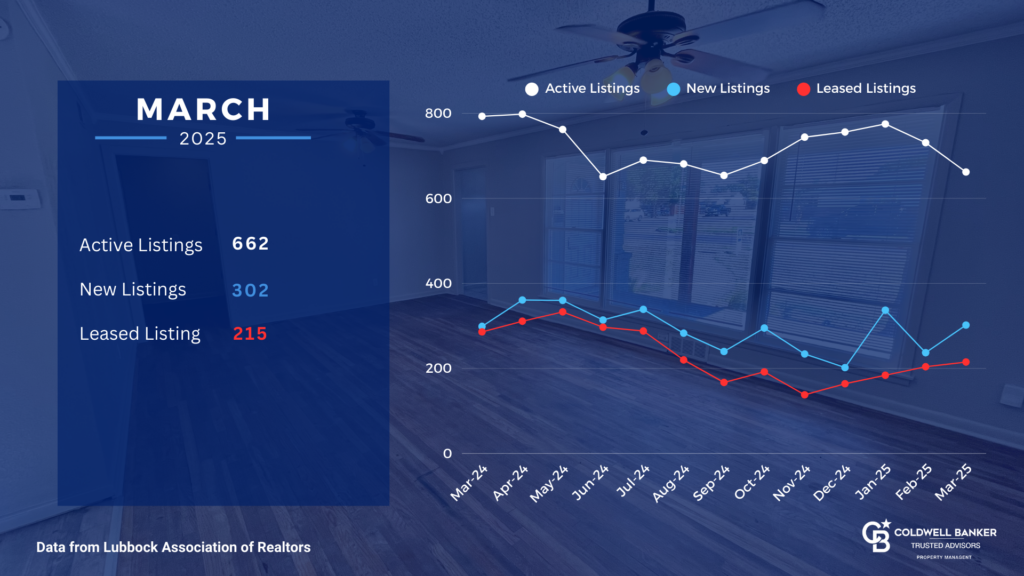

Monthly Glance

-

- Monthly rents year over year are up 1.78%

- Days on the Market still remain at over 60 days

- March 2025 showed a shift towards newer rentals being rented

- The number of leased properties fell by 22%

- The number of new rentals to the market fell by 16.5%

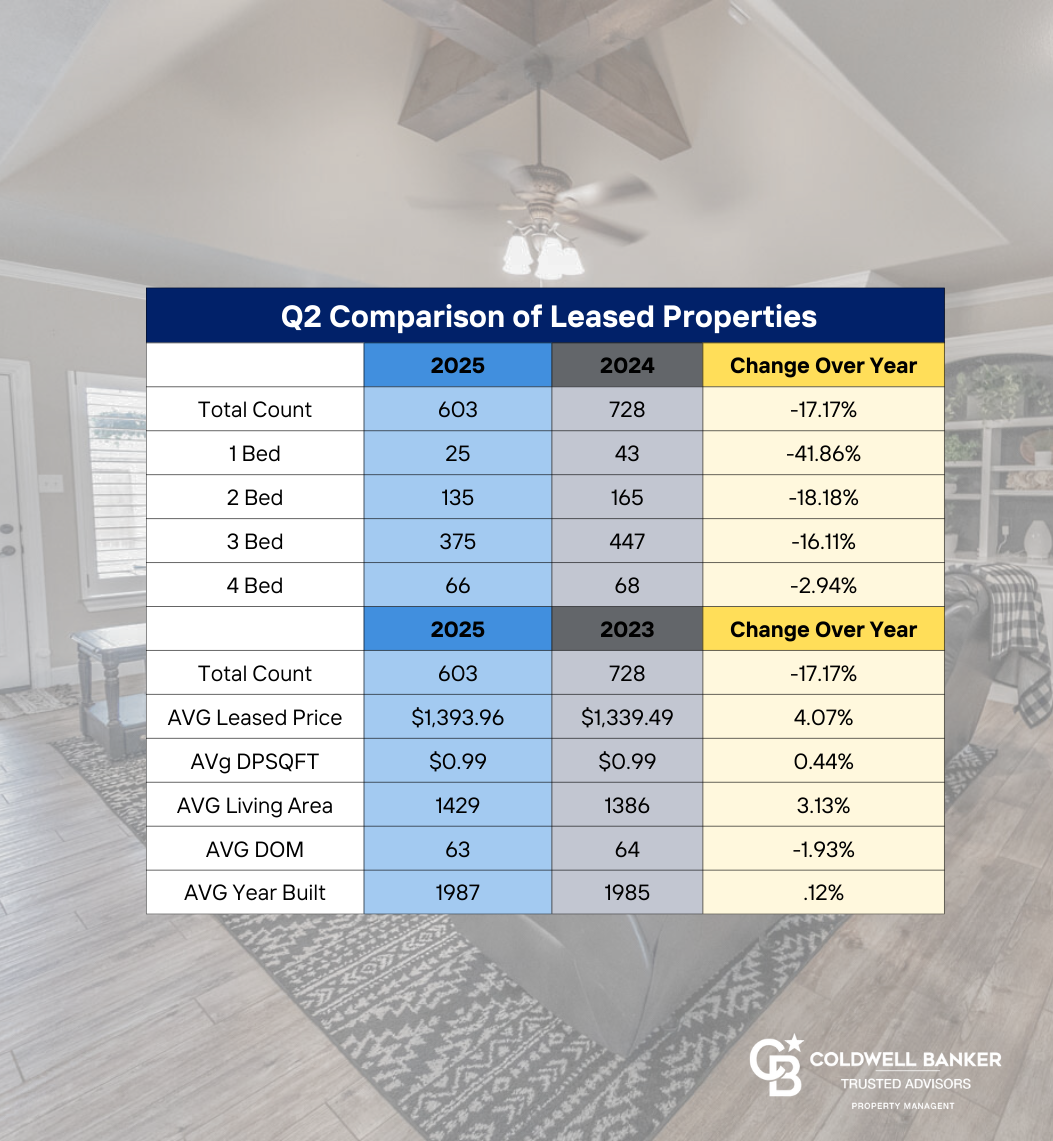

Q1 YOY at a Glance

- Average Rent is up by 4.07% compared to Q1 of 2024

- Days on Market still remain at over 60 days and has not moved

- Absorption of new properties has dipped compared to ending numbers of 2024

-Oscar Armendariz

Overall Numbers

Average Rents

Average rents have increase at above the inflation rate, by 4.07%. We want to caution the owner that this is a little false flag. The days on the market are still above the industry benchmark of 36 days. Simply put, while we may be getting a slight increase, it takes a long time to get leased. This is a revenue loss. Not to mention the number of leased properties decrease by 17%. This is one of the largest moves to the numbers and shows that tenants were not moving at the same rate that they were in 2024.

Days on Market

The average days on market (DOM) remained the same. We are not where we want to be. Once we can see the days on market averaging closer to 36 days and still see a rent increase, this will be a sign that the market is changing in favor of landlords.

Rental Demand Increase?

I can confidently say that rental demand is not increasing. This can be tracked by monitoring days on the market and the absorption rate.

The average number of days on the market was 38 in 2021 and 42 in 2022. The median was 25 and 29, respectively. In 2024, the average DOM was 54.

While the number of rented properties has increased, so has the available rentals. The supply is greater than the demand.

In 2019, the average rent in Lubbock was $1078. In 2022, the average rent rose 20% to $1351. As of 2024, the average rent is $1358. Effectively the same. Even if demand has increased, supply has met the call and then some. In 2021, the market absorbed 85% of what was listed. Compared to 77% in 2024

March 2025 saw an absorption rate of 78% compared to the 95% in March 2024. While the number of listings coming on the market has decreased, so has the number of rented units.

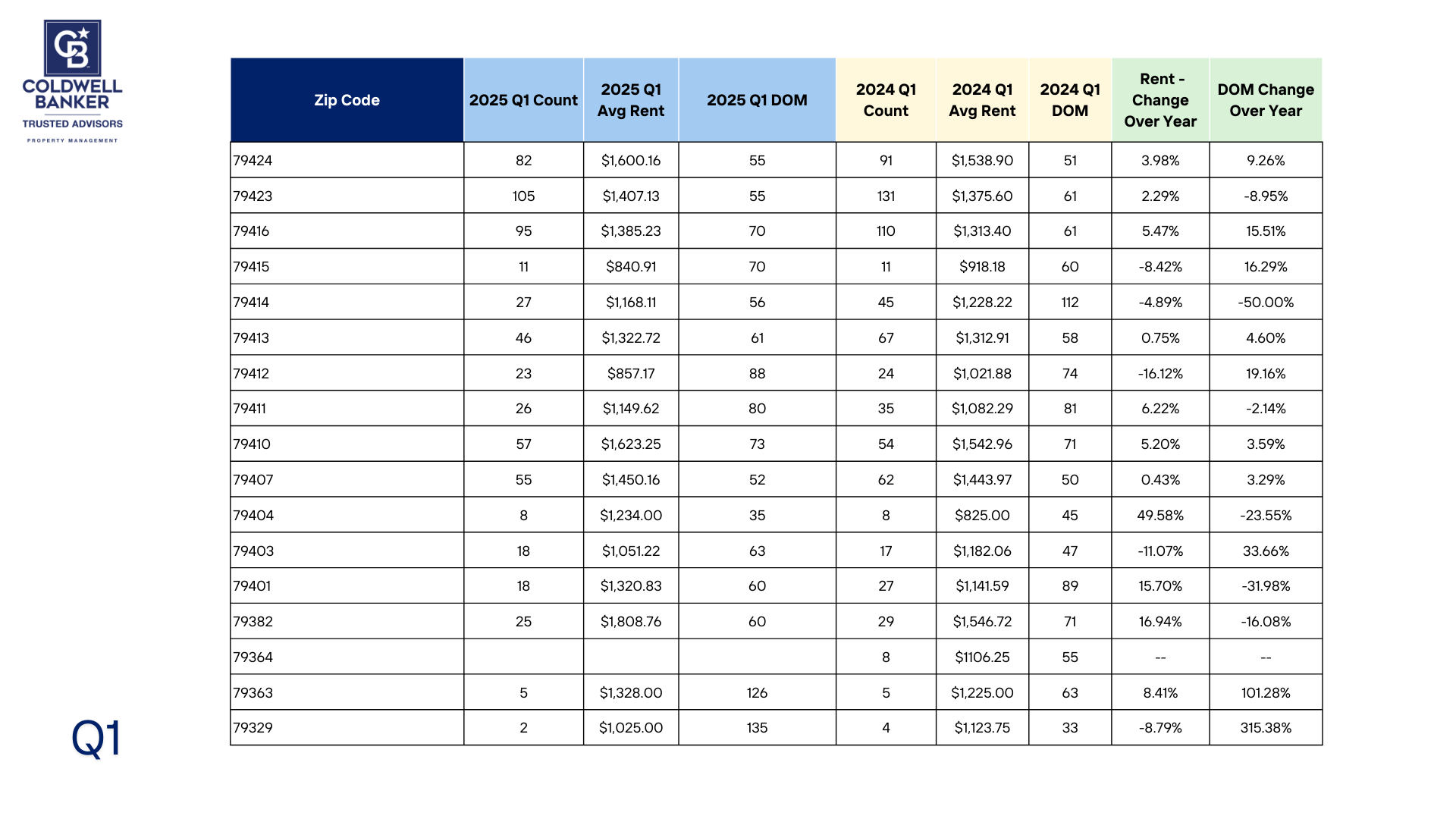

Activity By Zip Code

Southeast Lubbock, Southwest Lubbock, West Lubbock, and Wolfforth remain the strongest rental markets in Lubbock County, with each area experiencing rent increases compared to Q1 of 2024.

However, it’s worth noting that the number of leased properties in these areas has declined, which may indicate the early signs of a market slowdown.

New construction ZIP codes continue to be key drivers of rental demand across Lubbock.

Parting Thoughts

Lubbock Market Update: A Long-Term Play for Investors

As in previous reports, the rental market continues to move to the beat of its own drum. Some numbers are encouraging, while others leave me scratching my head. Still, I remain optimistic.

The core message remains the same as it has been for the past 18 months: single-family rental investing is a long-term strategy. Those entering the Lubbock market with expectations of high cash flow and quick returns are likely to be disappointed. The rental market has now become more affordable than the sales market, meaning margins for new investors are thinner than in previous years.

The upside? Property values are holding steady—and in some areas, even appreciating.

The downside? These gains are only realized upon sale. So, if you’re buying now, go in with a long-term mindset.

Even investors who purchased five or more years ago may feel frustrated with shrinking P&L statements. But take comfort in this: your equity has likely increased significantly, by approximately 34%. The average home price in Lubbock rose from $210,000 in 2019 to $280,000 in 2024.

However, it’s important to note that since 2022, prices have remained flat. Most Lubbock real estate professionals agree that while this plateau isn’t ideal, we expect home values to hold steady over the next 18 months with only modest growth.

In addition to cash flow and equity, single-family investors also benefit from tax advantages and depreciation. Taken together, these factors make owning a rental one of the most stable investment vehicles available.

For a detailed view of the 2025 Q1 report, click on the rental report. You can get a printable copy by clicking 2025 Q1 Market Update.

Work with Coldwell Banker

Simplified Property Ownership

Managing investment properties involves a myriad of tasks, from tenant screenings and rent collection to maintenance and legal compliance. Our comprehensive property management services are designed to take these burdens off your shoulders. We handle everything, ensuring your properties are well-maintained and profitable, allowing you to focus on what matters most to you.

Expertise in All Property Types

Whether you own a single-family home or a multifamily apartment complex, our team has the expertise to manage a diverse range of properties. We understand the unique needs and challenges of different property types and tailor our services to meet those needs efficiently and effectively.

Clear and Concise Communication

One of the cornerstones of our service is our commitment to clear and concise communication. We believe that transparency is key to a successful partnership. You will always be kept in the loop regarding the status of your properties, tenant issues, financial reports, and any other pertinent information. Our goal is to ensure you have complete confidence and peace of mind, knowing that your investments are in capable hands.

Cutting-Edge Technology

In today’s fast-paced world, staying ahead of technological advancements is crucial. At Coldwell Banker Residential Property Management, we leverage the latest technology and systems to enhance our services. From online portals for easy access to property information and financial reports to advanced marketing tools that attract high-quality tenants, we use technology to streamline processes and maximize efficiency.

Service-Oriented Approach

Despite our reliance on technology, we never forget that we are, first and foremost, a service company. Our priority is to provide exceptional service to both property owners and tenants. We pride ourselves on being responsive, attentive, and dedicated to meeting your needs. Our team is always ready to go the extra mile to ensure your satisfaction and the smooth operation of your properties.

Partnering with Coldwell Banker Residential Property Management means entrusting your investment properties to a team of experienced professionals who are committed to simplifying property ownership. With our expertise, clear communication, cutting-edge technology, and unwavering dedication to service, we ensure that your properties are managed efficiently and effectively. Let us help you maximize the potential of your investment properties while providing you with the peace of mind you deserve.

Contact us today to learn more about how we can assist you in achieving your property management goals.