August Update

January - August 2024

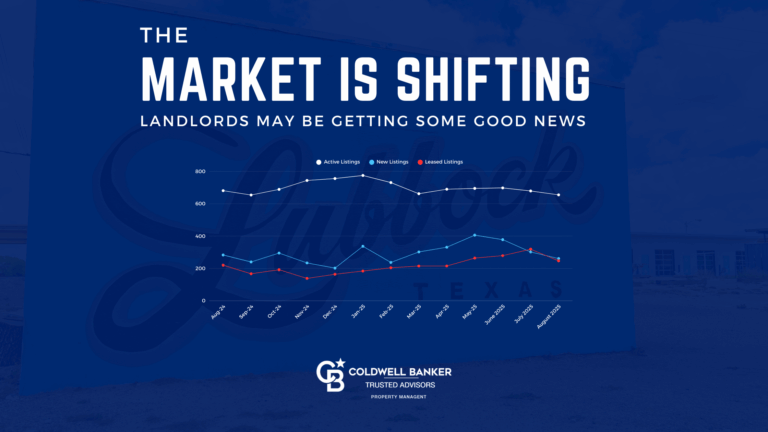

Surge in Listed Properties Indicates a Saturated Market

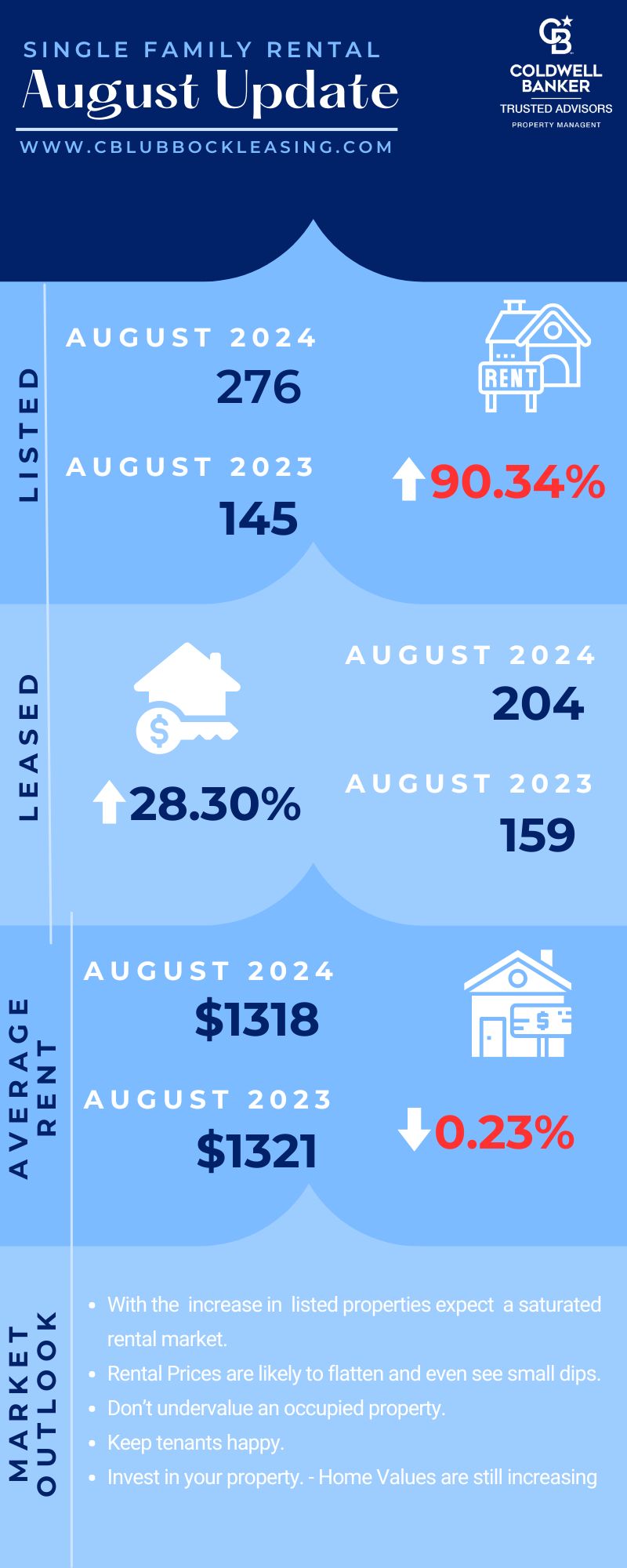

In August 2023, 145 properties were listed for rent. Fast-forward to August 2024, and the number of listed properties has jumped to 276—a substantial increase of 90.34%. This dramatic rise suggests the market is becoming saturated, with more properties available than renters actively seeking homes. For landlords, this could mean increased competition, making it more challenging to fill vacancies quickly.

Leased Properties Show Growth, But Rental Prices Decline

Despite the increased available properties, leased properties have seen an uptick. In August 2023, 159 properties were leased, while August 2024 saw 204 properties leased—a 28.30% increase. This growth in leasing activity, combined with the rising number of available properties, is a clear sign that the market is tilting in favor of renters.

Interestingly, the average rent has declined slightly. In August 2023, the average rent was $1,321, but by August 2024, it had dropped to $1,318—a decrease of 0.23%. This small decline suggests that rental prices are starting to flatten and may continue to dip as the market adjusts to the influx of new listings.

What Does This Mean for Property Owners?

Given these trends, property owners should be strategic in how they approach the current market. Here are a few key takeaways:

-

Expect a Saturated Market: With more properties available, the rental market will likely remain saturated for the foreseeable future. This could lead to longer vacancy periods and the need to offer competitive pricing to attract tenants.

-

Rental Prices May Flatten or Decline: As competition increases, rental prices are likely to stay flat or even dip slightly, as we’ve already seen with the small decrease in average rent. Property owners should be prepared for this and adjust their expectations accordingly.

-

Don’t Undervalue Occupied Properties: In a saturated market, retaining good tenants is crucial. An occupied property is often more valuable than an empty one. Keeping tenants happy can reduce turnover and help maintain consistent rental income.

-

Invest in Your Property: Although the rental market may face some challenges, home values are still increasing in many areas. Investing in property upgrades and maintenance enhances tenant satisfaction and boosts your asset’s long-term value.

The rental market is shifting, with a notable increase in available properties leading to signs of saturation. While rental prices are flattening and even dipping slightly, maintaining strong tenant relationships and investing in your property will be critical strategies for success. Staying adaptable and informed will help property owners navigate these changes effectively as we move forward.

Figure 5 shows the share of total housing-related spending by Texans as a percentage of the national average spending. The results are shown for all households and by income quintile. For instance, for all households, when it comes to housing expenses, Texans spend 102 percent as much, or 2 percent more than, U.S. households overall.

Why Groceries Matter

Why the Cost of Food and Healthcare Should Matter to Real Estate Investors

Real estate investors often evaluate potential investments based on location, market trends, and property values. However, a frequently overlooked but equally critical aspect is the broader economic environment, particularly the cost of essential goods and services like food and healthcare. These factors can significantly influence housing affordability, tenant stability, and market demand. Here’s why real estate investors should pay close attention to the rising food and healthcare costs.

Impact on Housing Affordability

The cost of living, including essential expenses like food and healthcare, is crucial in determining housing affordability. When necessities rise, households have less disposable income to allocate towards housing. According to an article by the Texas Real Estate Research Center, households are increasingly dedicating more significant portions of their income to non-housing essentials, directly impacting their ability to afford housing. For real estate investors, this means that rising costs in food and healthcare could limit the amount tenants can pay in rent or even lead to higher vacancy rates if people are forced to downsize or move to more affordable areas.

Tenant Stability and Demand

Stable tenants are the backbone of a successful rental investment. However, when essential costs like food and healthcare become more burdensome, tenants may struggle to meet their rent payments, leading to higher turnover rates and increased vacancies. The Texas Real Estate Research Center article highlights that rising healthcare costs are a growing concern for many households, consuming more of their budgets and leaving less room for other expenses, including rent. Investors must recognize that increasing essential living costs can lead to financial instability for tenants, which may reduce overall rental income and increase the likelihood of missed payments. Reports show that lower income Texas spend almost 18%-30% than the rest of the country. For those that choose to focus on lower income housing this is a major red flag.

Regional Variations in Cost of Living

The cost of food and healthcare can vary significantly across different regions, affecting local real estate markets in various ways. Investors who focus on markets with lower overall living costs might find more stable rental demand as residents in these areas are less burdened by rising prices of essentials. On the other hand, in regions where these costs are climbing rapidly, there could be a shift in population as people move to areas with a lower cost of living, affecting demand for real estate in both the departing and receiving regions.

Long-Term Investment Strategy

Understanding the interplay between the cost of essentials and housing affordability is crucial for long-term investment strategy. Markets, where healthcare and food costs are increasing rapidly, may see a slowdown in housing demand or even a drop in property values as affordability becomes strained. Conversely, areas with lower or stable costs could attract more residents, driving up demand for housing. Investors who account for these trends in their market analysis can better position themselves to navigate future challenges.

While property values and market trends are critical factors in real estate investing, the broader economic context, including the cost of essentials like food and healthcare, should not be ignored. As these costs rise, they directly impact housing affordability, tenant stability, and regional market dynamics, all of which are crucial for making sound investment decisions. By keeping an eye on these economic indicators, real estate investors can better assess risks, identify opportunities, and ensure their investments remain profitable in the long term.

For a more detailed analysis, check out the full article on consumer spending and housing costs by the Texas Real Estate Research Center here .

Do you even know what you Meme?

The conversation around tax reform has heated up once again, with Vice President Kamala Harris signaling support for a proposal that could significantly impact wealthy real estate investors. This proposal focuses on taxing unrealized gains—essentially, taxing the increase in property value even if the property hasn’t been sold. While this idea is not entirely new, it has sparked intense debate due to its potential economic implications and the specific demographic it targets. Here’s what you need to know about this controversial proposal.

What Are Unrealized Gains?

Unrealized gains refer to the increase in the value of an asset that has not yet been sold. For instance, if you bought a property for $500,000 and its value increased to $700,000, you would have $200,000 in unrealized gains. Under current tax law, you only pay taxes on these gains when you sell the property. However, the new proposal would tax these gains annually, even if you haven’t sold the property.

Who Would Be Affected?

The proposal is narrowly targeted at the wealthiest Americans. It would only apply to households with a net wealth of over $100 million. These individuals would face a minimum effective tax rate of 20-25% on unrealized capital gains, including any real estate holdings increase(Tax Foundation,Fox Business). This means that this tax would not apply to you unless your net wealth exceeds this threshold.

Debunking the Myths

Much misinformation has been circulating about this proposal, especially among homeowners and real estate professionals. The idea that typical homeowners will suddenly be hit with taxes on unrealized gains without selling their homes is entirely incorrect. The proposal is highly specific, targeting only the ultra-wealthy with over $100 million net worth. For most people, this is well beyond their financial situation now and in the future.

If you share or endorse the idea that this policy will affect average homeowners, you’re misinformed or spreading unnecessary fear. This type of rhetoric does a disservice to the public and clients who rely on accurate information. It’s important to clarify that this policy isn’t aimed at ordinary property owners; instead, it’s a highly targeted measure that, while controversial, won’t impact the average American’s homeownership.

Concerns About the Proposal

While it’s crucial to correct misinformation, it’s equally important to assess the proposal itself critically. Even though this tax would apply only to the ultra-wealthy, it still raises significant concerns. The primary issue lies in taxing often illiquid assets, such as real estate, farms, or privately held businesses. These assets can fluctuate in value and are not quickly sold or refinanced to pay annual taxes. For those with significant wealth tied up in these assets, the tax could force them to sell off parts of their holdings, potentially losing control of their businesses or properties.

Moreover, the ripple effects could extend beyond the ultra-wealthy. For instance, early investors or executives with large stock holdings in publicly traded companies might have to sell off large portions of their stock to pay this tax, potentially harming the company’s stock price and, in turn, affecting the value of ordinary Americans’ retirement accounts. Although the proposal aims to ensure that the rich “pay their fair share,” the unintended consequences could harm the broader economy, impacting everyone.

Kamala Harris’s support for this tax on unrealized gains has reignited discussions on how best to address wealth disparity in the United States. While the proposal targets explicitly the ultra-wealthy, its implications could ripple through the real estate market and beyond. As this debate continues, investors and property owners must stay informed and consider how these potential changes could impact their financial strategies.

Let’s be clear: this proposal is highly controversial for a reason. Taxing unrealized gains, especially on illiquid assets, is a complicated and potentially damaging policy. The economic impacts could be severe, and it’s startling that those pushing this policy may not fully grasp its potential to disrupt both the market and the broader economy. It’s a lesson in the importance of sound economic principles—a lesson that some appear to have missed.

Work with Coldwell Banker

Simplified Property Ownership

Managing investment properties involves a myriad of tasks, from tenant screenings and rent collection to maintenance and legal compliance. Our comprehensive property management services are designed to take these burdens off your shoulders. We handle everything, ensuring your properties are well-maintained and profitable, allowing you to focus on what matters most to you.

Expertise in All Property Types

Whether you own a single-family home or a multifamily apartment complex, our team has the expertise to manage a diverse range of properties. We understand the unique needs and challenges of different property types and tailor our services to meet those needs efficiently and effectively.

Clear and Concise Communication

One of the cornerstones of our service is our commitment to clear and concise communication. We believe that transparency is key to a successful partnership. You will always be kept in the loop regarding the status of your properties, tenant issues, financial reports, and any other pertinent information. Our goal is to ensure you have complete confidence and peace of mind, knowing that your investments are in capable hands.

Cutting-Edge Technology

In today’s fast-paced world, staying ahead of technological advancements is crucial. At Coldwell Banker Residential Property Management, we leverage the latest technology and systems to enhance our services. From online portals for easy access to property information and financial reports to advanced marketing tools that attract high-quality tenants, we use technology to streamline processes and maximize efficiency.

Service-Oriented Approach

Despite our reliance on technology, we never forget that we are, first and foremost, a service company. Our priority is to provide exceptional service to both property owners and tenants. We pride ourselves on being responsive, attentive, and dedicated to meeting your needs. Our team is always ready to go the extra mile to ensure your satisfaction and the smooth operation of your properties.

Partnering with Coldwell Banker Residential Property Management means entrusting your investment properties to a team of experienced professionals who are committed to simplifying property ownership. With our expertise, clear communication, cutting-edge technology, and unwavering dedication to service, we ensure that your properties are managed efficiently and effectively. Let us help you maximize the potential of your investment properties while providing you with the peace of mind you deserve.

Contact us today to learn more about how we can assist you in achieving your property management goals.